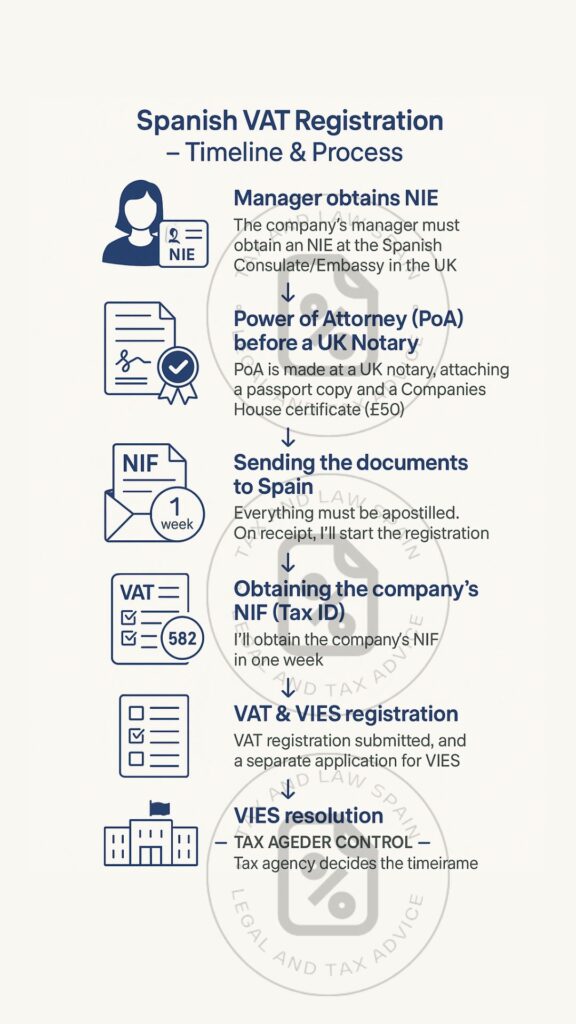

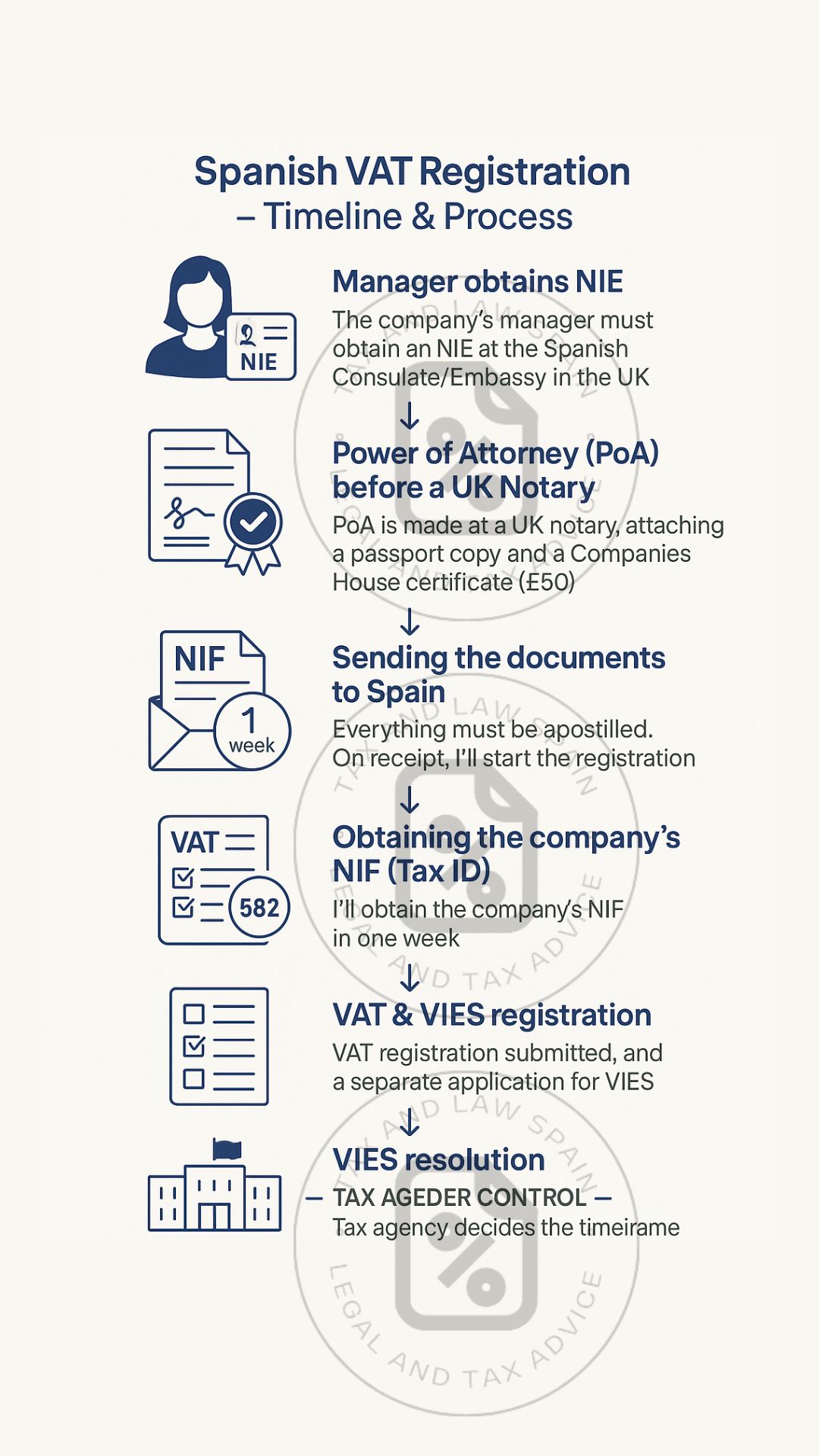

Those are the steps detailled:

-

Manager obtains NIE

-

The first and most important step: the company’s manager (director) must obtain a Spanish NIE (Número de Identificación de Extranjero).

-

This can be requested at the Spanish Consulate/Embassy in the nearest Consulate where the manager lives.

-

Please note: the manager must be resident in that Consulate area of competence to apply there. If he is not, please consult with me for alternatives.

-

-

Power of Attorney (PoA) before a UK/USA Notary

-

Once the NIE is issued, the manager must sign a PoA before a UK notary.

-

Only two documents are needed for the PoA:

• The picture page of the manager’s passport

• The company certificate from Companies House (around £50 in UK) -

This PoA, together with the certificate, must be legalized with the Hague Apostille and then translated officially into Spanish.

-

-

Sending the documents to Spain

-

Once I receive the apostilled and translated documents in Spain, I can start the registration.

-

-

Obtaining the company’s NIF (Tax ID)

-

I will obtain the company’s Spanish NIF in approximately 1 week.

-

-

VAT & VIES registration

-

After the NIF is issued, I file the VAT registration application (Modelo 036).

-

IMPORTANT: It is not enough to tick VAT registration on the initial form – after the first application, we must submit a separate application ticking box 582 to be included in the ROI (VIES register). Otherwise, the company will not appear in VIES.

-

-

VIES resolution

-

The Spanish Tax Agency (AEAT) decides the timeframe. It can take anywhere between 5 weeks to 6 months (average: 8–10 weeks).

-

Please note, this delay is not under my control but depends entirely on the tax authorities.

Spanish VAT registrationVIES_

-