Amazon’s General Product Safety Regulation (GPSR) Requirements 2024

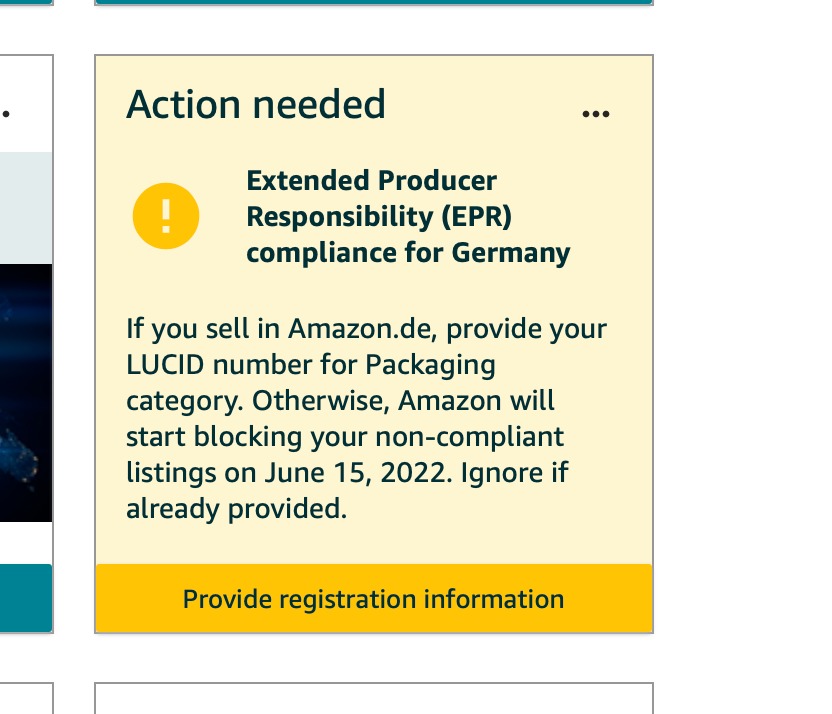

How to Ensure Your Products Meet Amazon’s General Product Safety Regulation (GPSR) Requirements As an Amazon seller, it’s essential to stay updated with evolving compliance standards, especially when it comes to the safety and transparency of the products you list. One crucial regulation you need to be aware of is the General Product Safety …

Amazon’s General Product Safety Regulation (GPSR) Requirements 2024 Read More »