How can I get a bank account certificate so that the tax office can refund my VAT?

I can get a bank account certificate so that the tax office can refund me the VAT you have previously paid to purchase the products you’re selling on online platforms such as Amazon or ebay within in the same country you’re re-selling the products (from a local provider) or the VAT I have paid to bring the products into Germany, Spain and therefore it is import VAT (when you do custom clearance, pay custom duty….

Today in our consultancy we personally take care that our clients get the necessary documentation for each process. In this case, to get the VAT refund from the German tax offices, what we will need first of all is:

- Your accountant needs to make the VAT report in which he/she will introduce in the necessary boxes to get VAT refunded.

- fIn the simplest cases where your company is registered in the USA or UK, you will usually have opened a transferwise (WISE) account, in the negative case, you’ll need to open it.

- After bank account verification, you can get a certificate needed.

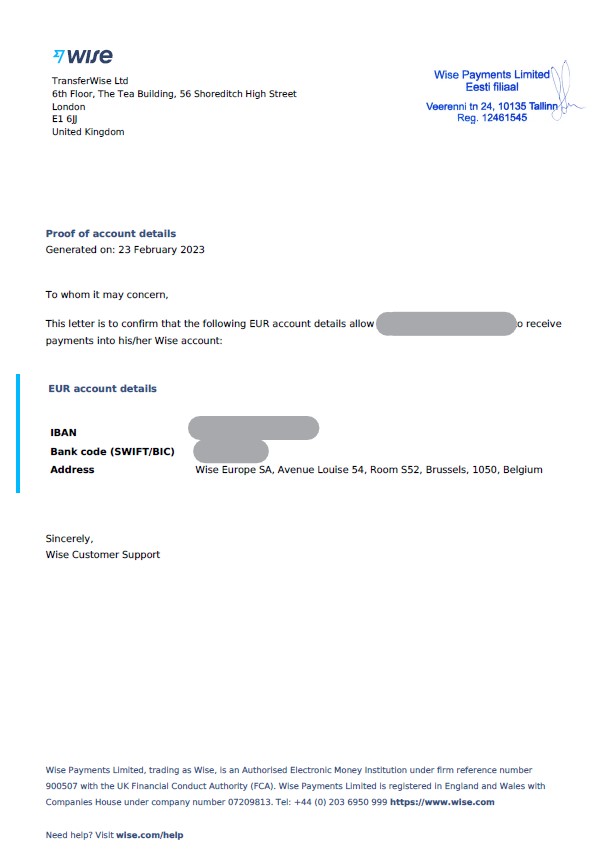

- If you want to get a VAT tax refund from the German tax office, we need the following certificate which you can obtain by logging into your company’s Wise account:

Go to “manage” >”account details >EU Account details > Get proof of account details and you can download a certificate there.

REMEMBER: The bank account MUST be on the name of your company, same account holder as the VAT certificate from the German Authorities.

For getting VAT back from the Spanish authorities, please contact us under:

thank you very much for this post if you think we have been able to help you or if you still have any questions, you can always contact us.