Power of attorney before the AEAT

Learn how you can grant power of attorney before the AEAT (Spanish Tax Agency)

Written by Erica Eced

In order to be able to carry out all the procedures before the Tax Agency on your behalf (filing tax forms), it is necessary that you give us power of attorney to do so.

How can I do it easily online?

To do so, follow these steps:

1º. Click on this link to the Tax Agency. https://sede.agenciatributaria.gob.es/Sede/procedimientoini/ZP01.shtml

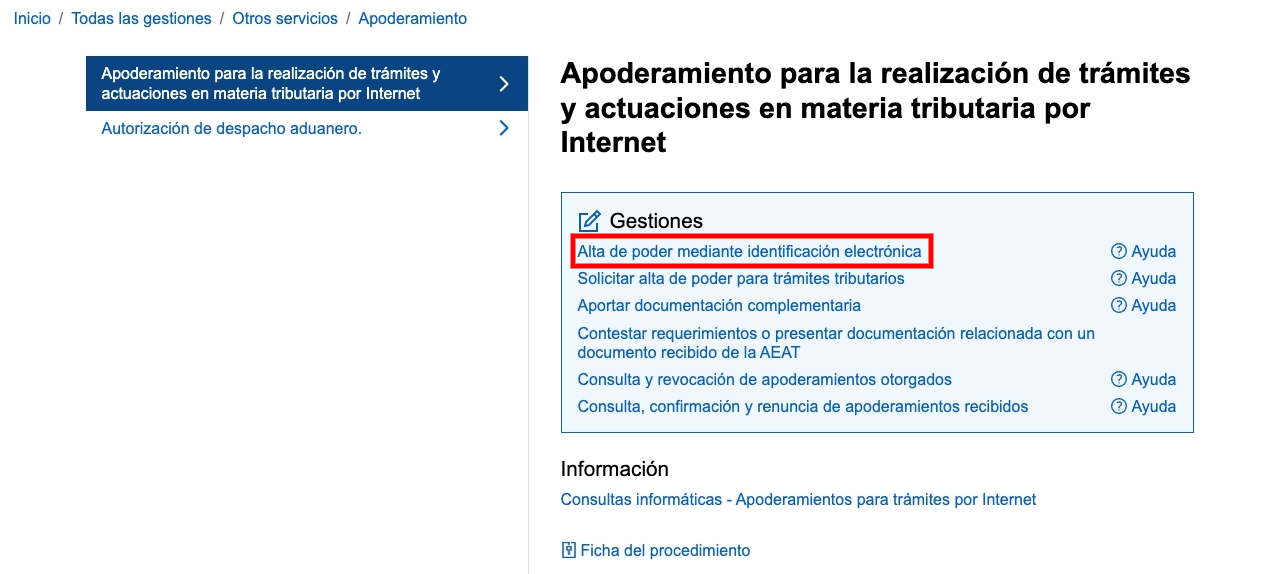

2º. Click on the option ‘Registration of power of attorney by electronic identification:

3º. From this point, you must identify yourself either with Cl@ve PIN (indicating your NIF and the date of validity of your DNI/NIE) or with your Digital Certificate.

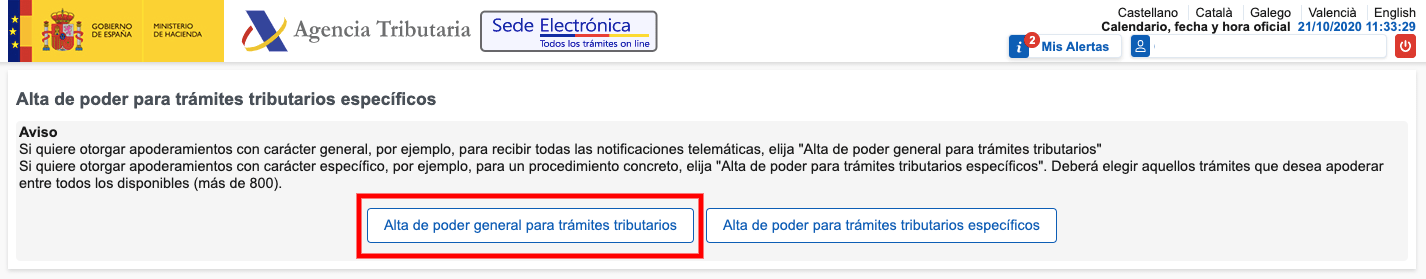

4º. Then click on ‘Registration of general power of attorney for tax procedures’:

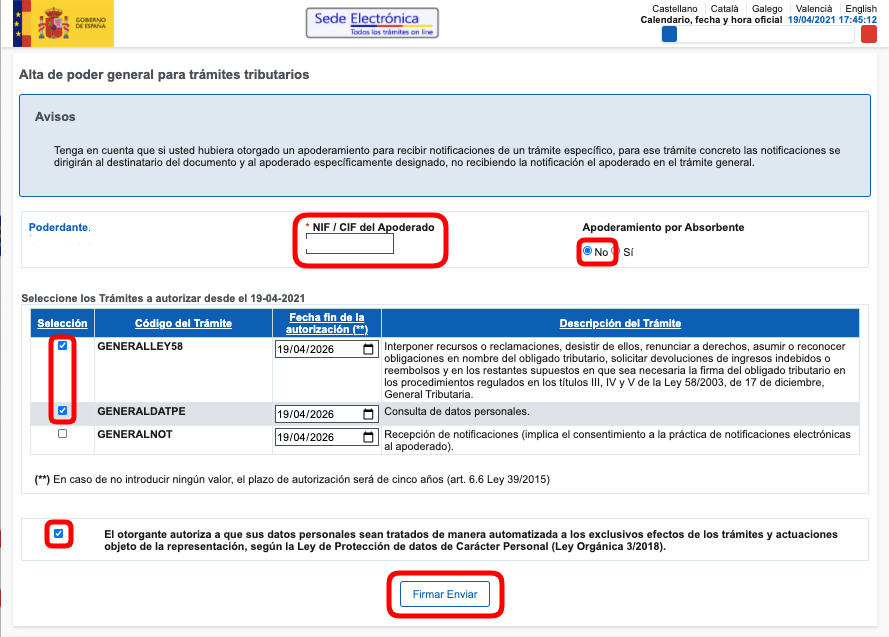

5º. Fill in the form as follows:

In the NIF / CIF of the Power of Attorney put 35594222C (this is the DNI of Erica, our professional ) and leave the ‘End date of the authorisation (**)’ as it is (today’s date plus 5 years).

In Power of Attorney by Absorber select the option ‘No’.

In the procedures to be authorised, select only GENERALLEY58 and GENERALDATPE (leave the End date of authorisation field empty).

Tick the data protection box

Click on the button ‘Sign send’: