How to List Your First Product on Amazon Seller Central (2025)

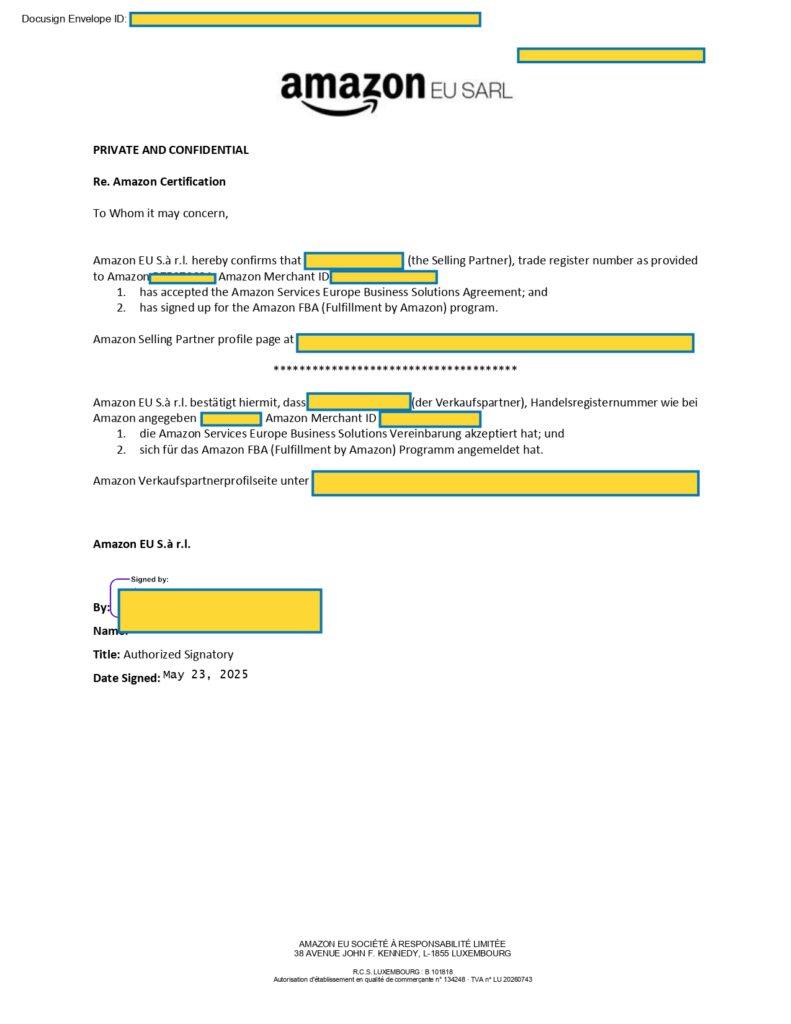

Breaking into Amazon FBA can be intimidating—you’re not alone. This video takes you step‑by‑step through listing a new product using Berberine Tea as an example. Here’s a structured guide based on its walkthrough: 1. Enroll in Amazon Seller Central Choose your selling plan—Individual or Professional. Provide business information (tax ID, address, bank account). 2. Create …

How to List Your First Product on Amazon Seller Central (2025) Read More »