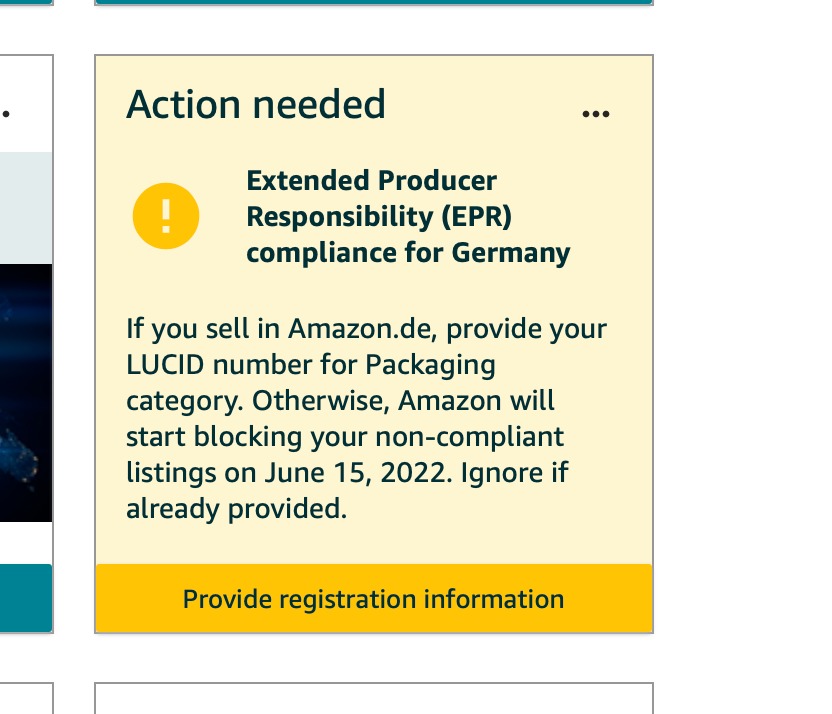

My German VAT number is currently invalid.

We received a request at the office from a customer: My German Amazon has never been selling, and it is all 0 declarations. My German VAT number has not been declared since June 2021, and now it is displayed in an abnormal state, that is, it is currently invalid. I don’t know if you can …